The Bank of America® Platinum Plus® Mastercard® Business card stands out as a reliable financial tool tailored for small business owners seeking efficient credit solutions. Combining competitive advantages with streamlined management features, this card offers a robust platform for enhancing cash flow and optimizing financial operations.

Designed with the needs of modern enterprises in mind, the Platinum Plus® Mastercard® Business card from Bank of America provides a compelling suite of benefits without the burden of an annual fee. From generous introductory incentives to comprehensive security measures, this card empowers businesses to navigate expenses effectively while enjoying flexibility in payment terms. Whether managing day-to-day transactions or planning for future growth, this card delivers the financial tools necessary to drive business success.

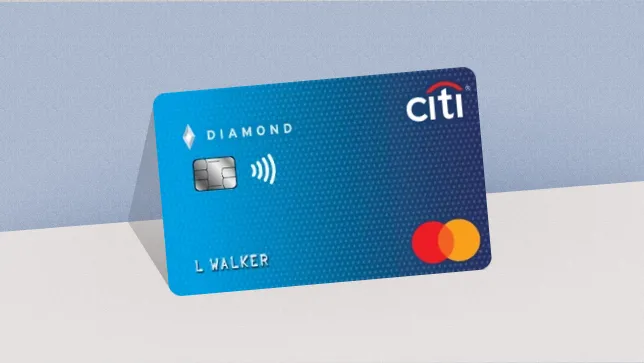

Key information about the Bank of America® Platinum Plus® Mastercard® Business card

The Bank of America® Platinum Plus® Mastercard® Business card offers new cardholders a $300 online statement credit after spending $3,000 within the first 90 days of account opening. It features a 0% introductory APR on purchases for the initial 7 billing cycles, making it an attractive option for businesses looking to manage expenses efficiently without incurring interest charges upfront.

With no annual fee and the ability to issue employee cards at no extra cost, this card provides flexibility and cost savings for small businesses seeking essential financial management tools.

How does the annual fee work?

The Bank of America® Platinum Plus® Mastercard® Business card does not impose an annual fee, offering a straightforward cost structure beneficial for small business owners. This absence of an annual fee helps businesses save on recurring expenses associated with maintaining a credit card, providing financial flexibility without the need to offset an annual charge against potential benefits.

How is the credit limit determined?

The credit limit for the Bank of America® Platinum Plus® Mastercard® Business card is determined based on an evaluation of the applicant’s financial capability and credit profile. For conventional cards like this one, the limit is typically set considering credit history, credit score, stated income, and existing financial obligations.

In contrast, secured or prepaid cards require a deposit as collateral, determining the available credit limit based on this deposit, which may be refundable upon account closure or transition to an unsecured card as the cardholder’s credit situation improves.

Credit card benefits

- $300 online statement credit: Earn a $300 online statement credit after spending $3,000 in the first 90 days.

- No annual fee: Enjoy the benefits of the card without paying an annual fee, reducing overall costs for businesses.

- 0% introductory APR: Benefit from a 0% introductory APR on purchases for the first 7 billing cycles, helping manage cash flow without incurring interest charges.

- Employee cards at no additional cost: Issue employee cards at no extra charge, with customizable credit limits, facilitating expense management for your team.

- Cash flow management tools: Access a suite of online services including automatic payments and transaction downloads to QuickBooks, simplifying financial management.

- Travel and emergency services: Receive travel accident insurance, auto rental insurance, and other emergency services, providing peace of mind during business trips.

$300 online statement credit

A standout benefit of the Bank of America® Platinum Plus® Mastercard® Business card is its $300 online statement credit offer. This substantial incentive rewards new cardholders for their initial spending, providing immediate financial relief and effectively reducing the overall cost of business expenses within the first few months of card ownership.

This feature not only enhances cash flow management but also incentivizes larger purchases or essential business investments early on, contributing significantly to the card’s appeal for small business owners looking to maximize their financial resources.

Disadvantages

- Variable APR: After the introductory 0% APR period ends (typically after the first 7 billing cycles), the APR can range from 16.49% to 27.49%, depending on creditworthiness. This variability may lead to higher interest charges if balances are carried month-to-month.

- Cash advance fees: The card incurs a high variable APR of 29.49% on cash advances, coupled with fees that may apply for such transactions. This can make cash advances costly compared to regular purchases.

- Credit approval criteria: Like most credit cards, approval is subject to credit approval criteria, which may include a good to excellent credit score and other financial qualifications. This could potentially limit access for some applicants who do not meet these requirements.

High variable APR

A standout disadvantage of the Bank of America® Platinum Plus® Mastercard® Business card is its high variable APR for cash advances, set at 29.49%. This rate, combined with associated fees, makes cash advances significantly more expensive compared to regular purchases or other forms of credit. Businesses relying on cash advances for liquidity or emergencies may find this cost prohibitive, impacting their overall financial planning and budgeting strategies adversely.

Who can apply for this card?

The Bank of America® Platinum Plus® Mastercard® Business card is available to individuals and small business owners who meet specific eligibility requirements. Applicants typically need a good to excellent credit score, a steady income to support credit obligations, and must be legal residents of the United States.

Proof of business ownership or employment involvement in managing business finances may also be required. Additionally, Bank of America assesses applicants based on their credit history, debt-to-income ratio, and overall financial standing to determine eligibility and credit limit, ensuring responsible credit management and financial stability.

How to apply for the Bank of America® Platinum Plus® Mastercard® Business card

Via WebSite

To apply for the Bank of America® Platinum Plus® Mastercard® Business card online, start by visiting the Bank of America official website and navigating to the section dedicated to business credit cards. Here, you will find comprehensive details about the card’s benefits, terms, fees, and eligibility requirements tailored for small business owners. Click on the “Apply Now” button to initiate the application process, which redirects you to an online form.

Complete the application form by providing accurate personal and business information. This typically includes your full name, business name, contact details, Social Security number or Employer Identification Number (EIN), annual income, and details about your business structure. Ensure all information is correct before submitting to avoid delays in processing.

As part of the application, you will need to review and agree to the terms and conditions associated with the Platinum Plus® Mastercard® Business card. These terms cover aspects such as interest rates, fees, rewards, and the cardholder agreement. Submit the application electronically through the website after agreeing to the terms.

After submitting your application, Bank of America will review your information and assess your creditworthiness. This process may take a few business days. If additional verification or information is required, Bank of America may contact you directly.

Upon approval, you will receive your Platinum Plus® Mastercard® Business card by mail. Follow the activation instructions provided with your card to start using it for business expenses within your approved credit limit.

You will be redirected to another website.